michigan use tax exemptions

Michigan Sales Tax Exemptions. Nonprofit Organization with an authorized letter issued by Michigan Department of.

Exemption For Michigan Data Centers January 2016 Avalara

Notice of New Sales Tax Requirements for Out-of-State Sellers.

. The Charitable Nonprofit Housing Property Exemption Public Act 612 of 2006 MCL 2117kk as amended was created to exempt certain residential property owned by a charitable nonprofit. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into. Once completed you can sign your fillable form or send for signing.

For transactions occurring on or after October. Use Fill to complete blank online MICHIGAN pdf forms for free. Nonprofit Internal Revenue Code Section 501c3 501c4 or 501c19 Exempt Organization.

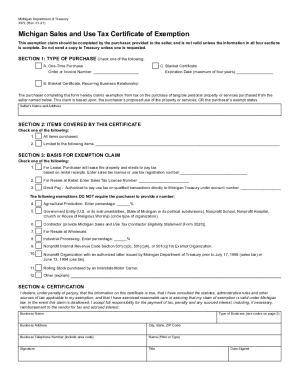

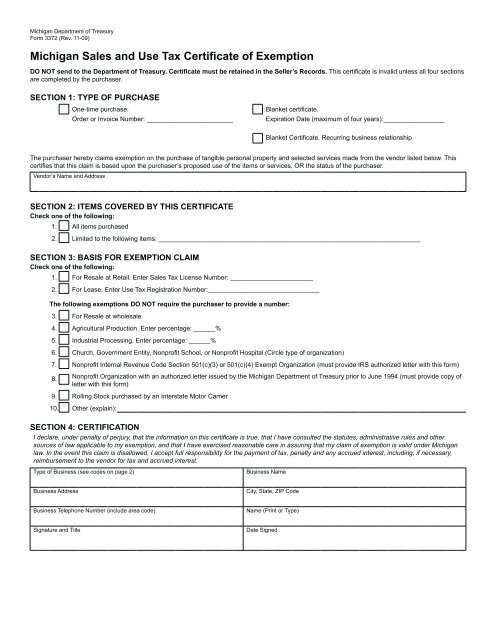

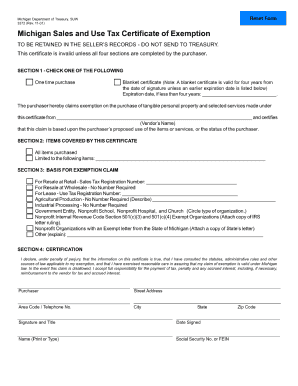

For transactions occurring on and after October 1 2015 an out-of-state seller may be. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. Instructions for completing Michigan Sales and Use Tax Certificate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax.

The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some. What is Exempt From Sales Tax in Michigan. 2022 Michigan state use tax.

The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in. If you received a Letter of Inquiry Regarding Annual Return for the return period of 2021 visit MTO to file or 2021 Sales Use and Withholding Taxes Annual Return to access the fillable form. All forms are printable and downloadable.

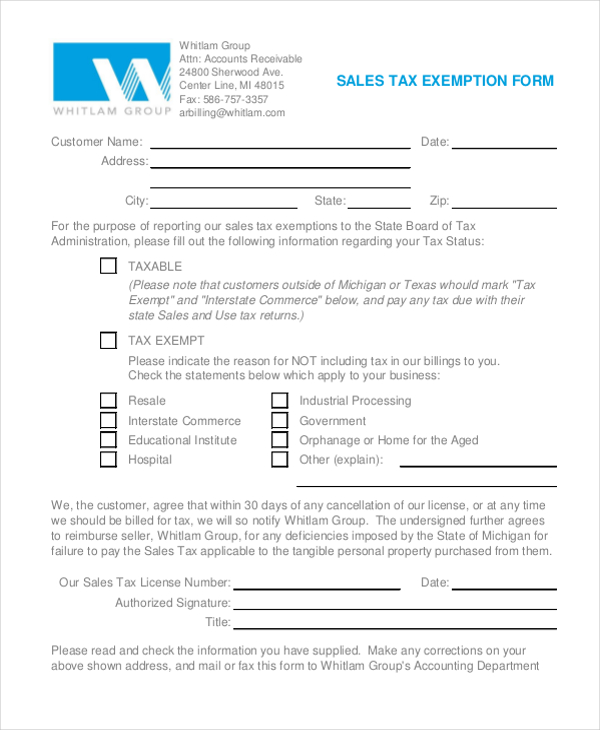

Sales Tax Exemptions in Michigan. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form 3372.

Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied. Several examples of exemptions to the. Michigans use tax rate is six percent.

Use tax is a companion tax to sales tax. The sales tax and use tax statutes operate differently but are intended to supplement and complement each other to collect on the overall 6 tax liability. Appropriate exemption is obtained by supplying a certificate of exemption and copy of the IRS 501c3.

The MI use tax only applies to certain purchases. Department of Treasury holding that the Michigan Use Tax apportionment rules apply in situations where property is simultaneously used for exempt and non-exempt. Producers will note on item 4 in section 3 that you are to indicate the percentage of the purchase item is for agricultural production and that percentage would be.

Make check payable to the State of Michigan. The State of Michigan does not issue tax exempt numbers to the University. Streamlined Sales and Use Tax Project.

Carefully write the business tax account number SUW and the return period on the memo line of the check. Retailers Retailers purchasing for resale should provide a signed exemption certificate by completing form 3372 Michigan Sales and Use Tax Certificate of Exemption and. This practice guide discusses generally the Michigan sales tax obligations of Michigan public schools under the Michigan General Sales Tax Act Act 167 Public Acts of Michigan 1933 as amended MCL 20551 etseq The Act imposes a tax on most retail sales of tangible personal property at a rate of 6 of the sellers gross proceeds from the.

Michigan manufacturers can easily purchase exempt manufacturing items by supplying their vendors. How to Claim the Michigan Sales Tax Exemption for Manufacturing.

Mi Sales Tax Exemption Form Animart

Download Business Forms Premier1supplies

Michigan Sales Tax Guide And Calculator 2022 Taxjar

Free 8 Sample Tax Exemption Forms In Pdf Ms Word

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Irs Form 3372 Fill Online Printable Fillable Blank Pdffiller

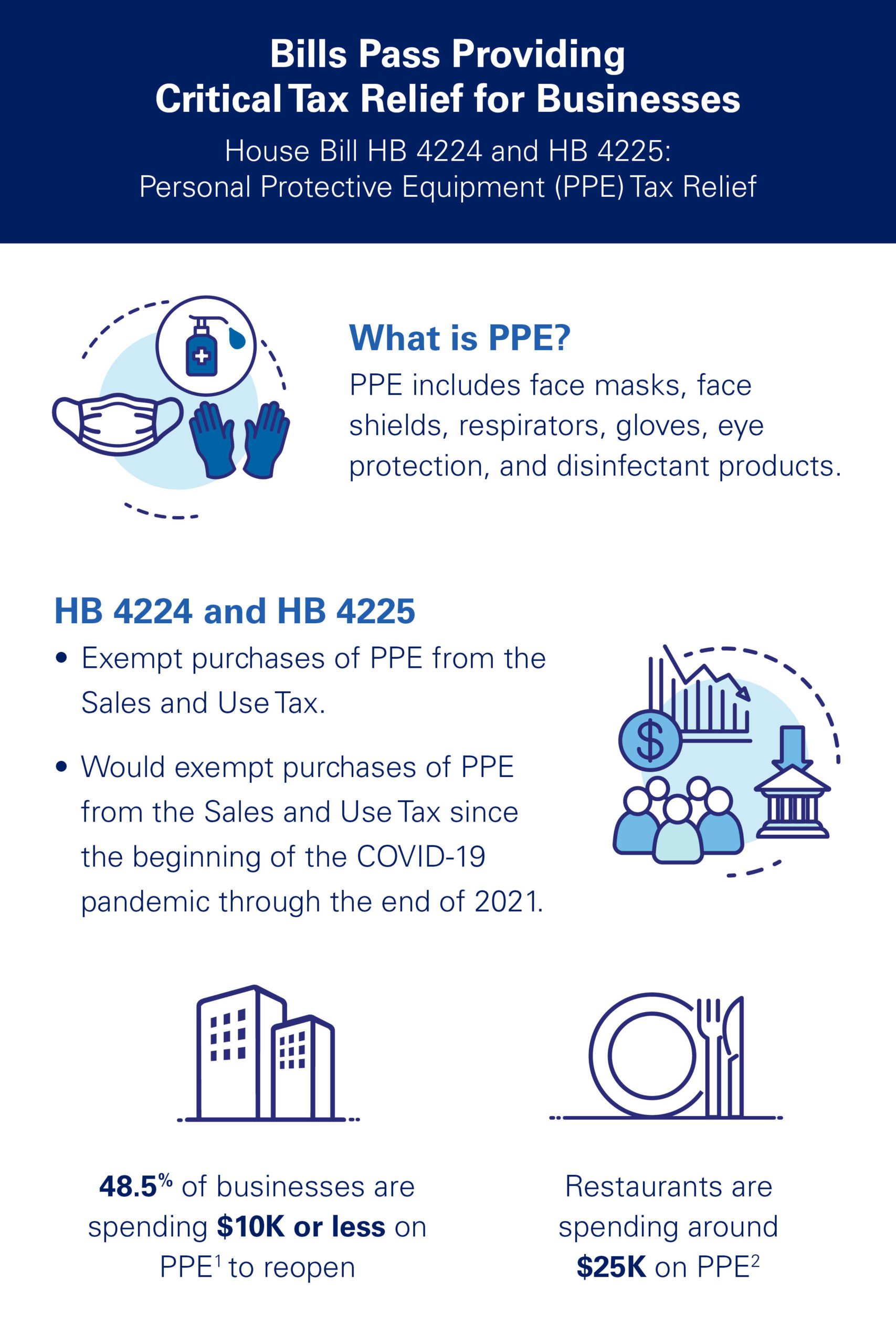

Why Gov Needs To Sign Chamber Backed Ppe Tax Relief Detroit Regional Chamber

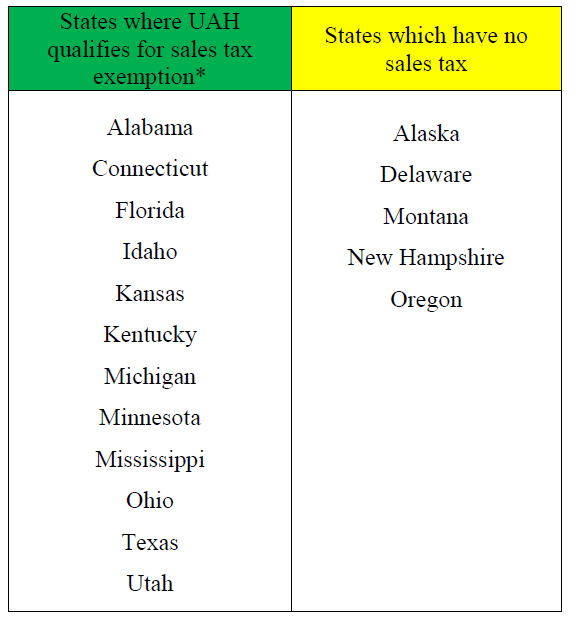

Uah Business Services News Tax Exemption Guidelines

Michigan Data Center Sales And Use Tax Exemption Walton

What Transactions Are Subject To The Michigan Use Tax Kershaw Vititoe Jedinak Plc

Michigan Eliminates Good Faith Requirement Avalara

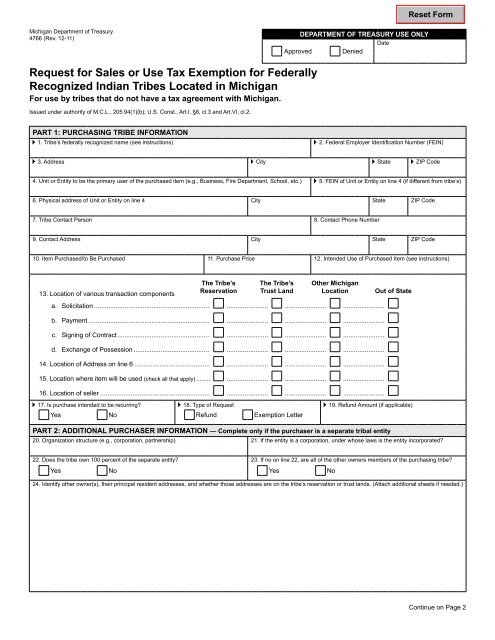

4766 Request For Sales Or Use Tax Exemption State Of Michigan

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub

Form 3372 Fillable Michigan Sales And Use Tax Certificate Of Exemption

Shiawassee County Farm Bureau Michigan Farm Bureau Policy Saving You Money Facebook

Michigan Is In A Hurry To Cut Taxes Is A Pet Food Tax Exemption Next Bridge Michigan

Michigan To Enforce Sales Tax On Online Out Of State Retailers